2024 engineering and construction industry outlook

Sustainable practices and technology advancements are likely to shape the industry in 2024.

The construction industry entered 2023 marked by a 7% increase in nominal value added and a 6% increase in nominal gross output compared to the previous year.1 As of the third quarter of 2023, nominal construction spending maintained a steady upward path.2 However, if trends in real GDP data continue from 2022, it is important to note that much of the topline growth is likely being driven by price inflation versus volume. In addition to grappling with ongoing inflation, the industry is facing volatility in material prices and increasing labor costs. Another significant challenge is the ongoing shortage of skilled labor, which continues to impact the sector. Moreover, high interest rates and tighter lending standards are also impacting construction activity.

However, looking ahead to 2024, there could be a boost to construction associated with manufacturing, transportation infrastructure, and clean energy infrastructure, as funds from three key pieces of legislation passed in 2021 and 2022—the Infrastructure Investment and Jobs Act (IIJA), the Inflation Reduction Act (IRA), and the Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act—are expected to flow into the industry.3 As such, construction confidence remains high, with the Associated Builders and Contractors (ABC) identifying expectations for an increase in profit margins and staffing levels, particularly in the first half of 2024.4

As E&C firms plan for the upcoming year, there are five key areas that may help them capitalize on the projected industry growth and tackle unforeseen challenges:

- Heightened focus on sustainability and efficiency

- Advancement of digitalization and generative AI

- Differentiated impact of market uncertainty across the residential and nonresidential segments

- Change in operating strategies to manage volatility in costs, demand, and customer priorities

- New workforce norms to bridge the lingering talent and skills gap

1. E&C firms strive to balance sustainability and efficiency

Sustainability continues to be a business imperative for the construction industry. E&C companies face a multidimensional challenge on this front as they adapt to evolving market trends and environmental regulations and meet customer demands for greener buildings, while also preventing construction costs from accelerating too rapidly.

According to the International Energy Agency, buildings account for 30% of global energy consumption and 26% of global energy-related emissions.5 With the growing adoption of efficient building materials and sustainable construction practices, the industry is expected to be better positioned to accelerate changes and align with the International Energy Agency’s Net Zero Emissions by 2050 Scenario, which requires all new buildings and 20% of existing structures to be zero-carbon-ready by 2030.6 According to the US Green Building Council’s 2023 report, sustainability is a top priority for most surveyed E&C firms, as it aligns with their organizational mission and business strategies.7 Strategies such as reducing the embodied carbon of key construction materials, passive design principles, and the use of energy-efficient equipment can accelerate decarbonization by minimizing the overall carbon dioxide emissions associated with both the construction and operation of a building.

The US government is also prioritizing sustainable construction through the Federal Buy Clean Initiative. For instance, the initiative has led to the specification of more than US$2 billion for the procurement of lower-carbon construction materials like asphalt, concrete, and steel for federal procurement and their use in federally funded projects. It also resulted in the allocation of US$100 million to support state, local government, and public utility purchases of building products derived from converted carbon emissions.9

The IRA incentivizes businesses for energy-efficient improvements such as insulation, lighting, and heating, ventilation, and air conditioning systems through funding of more than US$1.7 billion on top of additional tax credits.10 Efficiency—that is, delivering structures that minimize resource usage while optimizing operational performance—is likely to become key to sustainable construction. The upfront costs associated with sustainable construction can be offset by reduced long-term life cycle costs. Such reductions in costs may be derived from the usage of high-performance facades and energy-efficient systems.

Furthermore, firms can experiment with an array of passive design techniques to bolster building efficiencies and reduce energy demand. These techniques may include orienting structures (buildings) to avoid or capture solar heat, designing green roofs to reduce heat absorption and provide insulation, incorporating energy-efficient fixtures and daylight-responsive lighting controls to reduce energy consumption, and designing building envelopes for effective insulation and moisture control to stabilize indoor temperatures.12 Delivering sustainable structures in a cost-effective manner is paramount for E&C firms in differentiating themselves in the market and satisfying customer priorities. E&C companies are likely to continue exploring innovative and technology-enabled strategies to balance sustainability and efficiency in 2024.

In addition to balancing sustainability with efficiency, the increasing occurrences of severe weather events such as hurricanes, floods, and wildfires have raised the focus on resilient design. As highlighted by the US Green Building Council, building owners and customers are showing greater interest in green building approaches that address a range of resilience demands.13 With such new demands on both sustainability and resilience, the industry is poised to take advantage of an increase in the development of advanced and emerging materials such as self-healing or high-performance eco-friendly concrete, electrical steel, graphene, and carbon fiber composites. These new purpose-driven materials are engineered to surpass the capabilities of naturally occurring materials and offer benefits such as durability, flexibility, circularity, stability, and efficacy.14 Sustainable materials such as treated wood, low-carbon bricks, and silica fumes15 may also see an uptick as E&C firms work to reduce the carbon footprint of new buildings.

Regardless of the method for achieving sustainability, E&C companies are expected to begin prioritizing sustainable design tactics and structural performance during the conceptual phase. Such early planning can result in substantial reductions in carbon emissions.16 E&C companies can also incorporate circular economy principles early within the design and construction process. Based on these principles, companies may engage in reusing materials, designing structures for disassembly, and reducing waste to address environmental concerns and support business growth.

Utilizing technologies and techniques such as optioneering powered by generative design, simulations, and building information modeling (BIM) can allow companies to model a building’s performance and carbon footprint, and estimate both cost and schedule prior to construction, thereby enabling seamless project delivery. These technologies can also improve efficiency, increase delivery confidence, and hone resource allocation, ultimately lowering project expenses and risks. Furthermore, applications of BIM, IoT sensors, data analytics, and energy optimization techniques can contribute to reducing emissions.

2. E&C firms to unlock new value by leveraging digitalization and adopting generative AI

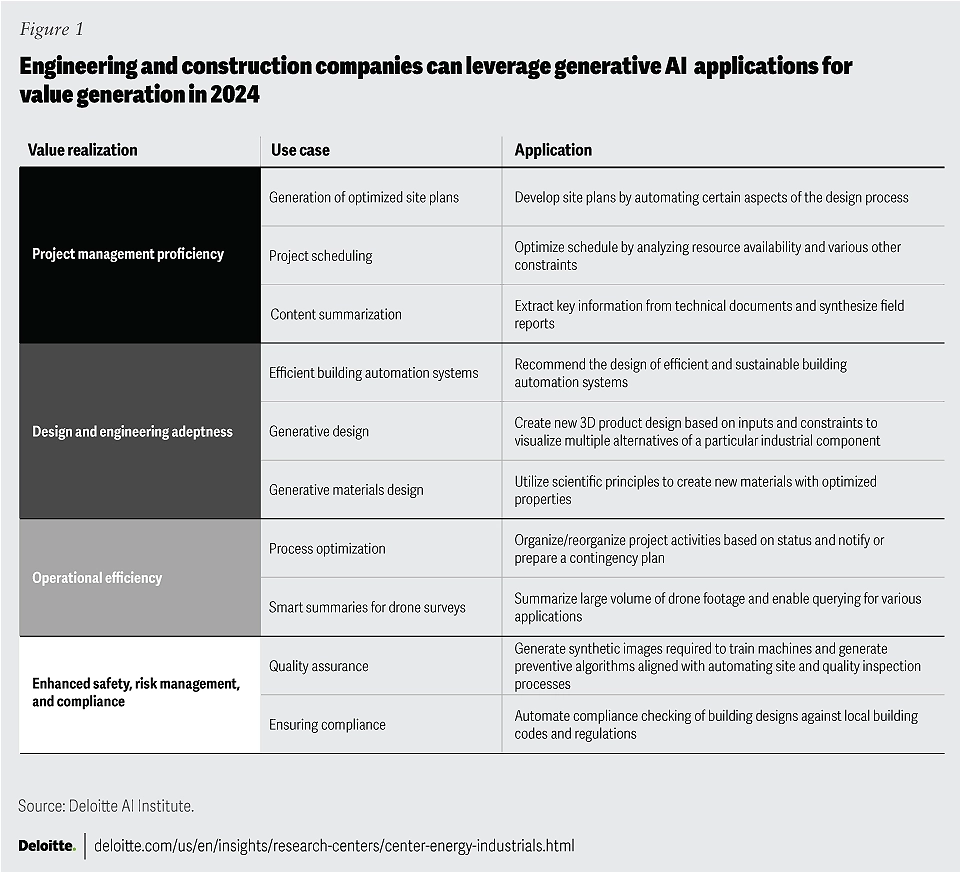

In recent years, the E&C industry has gradually adopted digital technologies to help improve processes and efficiencies. However, with the rise of generative AI and other disruptive technologies, the sector is now seemingly poised to realize improvements in project design, schedule optimization, cost controls, site inspection, safety, compliance, and quality assurance.

The Deloitte AI Institute defines generative AI as “a subset of artificial intelligence in which machines create new content in the form of text, code, voice, images, videos, processes…”

Industry leaders continue to prioritize technology investments, aiming for efficiency improvements in order to mitigate ongoing workforce, cost, and supply chain challenges.18 The rise of generative AI could mark a pivotal moment in the industry’s digital transformation, building on the momentum gained during the pandemic. Both E&C firms and construction technology companies are actively exploring generative AI’s potential for enhancing efficiencies and are working on solutions to harness this technology to suit their business needs.

In a recent Deloitte survey, 55% of chief operating officers indicated that the main barrier to creating business value with artificial intelligence was identifying the right use cases.20 Additionally, top of mind for E&C firms are concerns around cyber risk, data security, and lack of trust.21 Developing comprehensive risk mitigation strategies can help address concerns as companies explore generative AI applications.

While companies experiment with the practical applications of generative AI, they can continue to accelerate advancements in various other AI and emerging technologies. These technologies may include drones, autonomous guided vehicles, robotics, BIM, IoT sensors, and others that are being deployed to help drive value realization. For instance, with foundational digital technologies already in place, drones and autonomous guided vehicles could be used in a range of scenarios at construction sites from inspection and worksite monitoring applications to task optimization in areas such as material delivery, surveying, and installations.

These emerging technologies and their applications can improve profit margins, foster stronger partnerships, help relationships between different stakeholders and functional departments, and improve integrated project delivery through transparent and trusted data-sharing. E&C firms can leverage advancements in technology not only for increased productivity but also to explore higher-level opportunities, including new services or business models that may have been uneconomical previously.23

It is important to recognize that these technologies depend on human intelligence and oversight. Regardless of advancements in construction technology, industry leaders are exploring a human-in-the-loop concept that requires the involvement of highly skilled individuals to carry out tasks such as fact-checking, in-depth analysis, and understanding the complex details needed for each construction process.24 Furthermore, for technology initiatives to gain widespread adoption and scalability, companies should have strong ecosystem alliances and partners,25 including technology providers, operations vendors, contractors, and automation vendors, among others.

3. E&C firms to navigate the varied effects of ongoing economic uncertainty

After a year of rising interest rates and high inflation, there has been further segmentation in the market since last year’s E&C industry outlook. The construction industry is expected to face the lingering effects of economic uncertainty for yet another year. The federal funds interest rate recorded a 22-year high in September 2023 at 5.3%, and a 108% year-over-year increase.26 Additionally, the consumer price index for all urban consumers in US cities increased by 4% year over year in August 2023.27 Further tightening of monetary policy by the Fed could trigger concerns of an economic downturn, even as inflation cools.

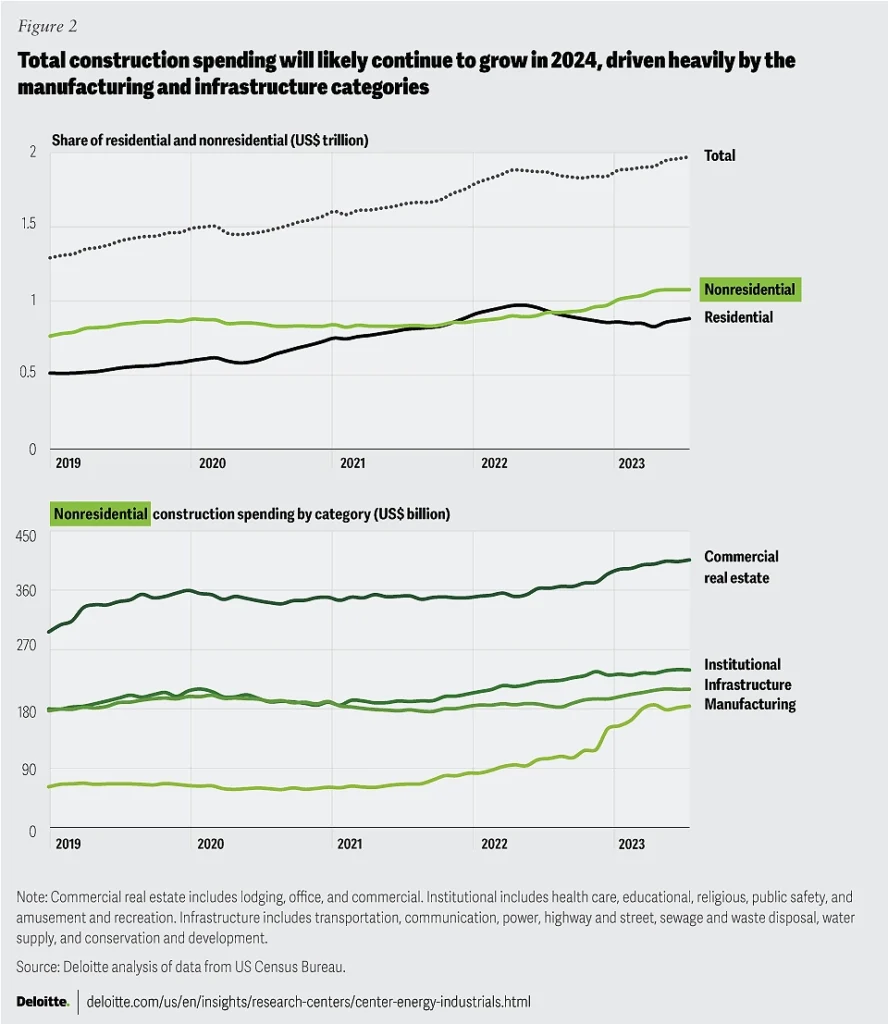

Broader economics, monetary policy, and overall market uncertainty have had varied impacts across different segments. Total construction spending stood at US$1.98 trillion in August 2023, a 7.4% increase since the previous year. This total spending was primarily driven by nonresidential construction spending, which recorded growth at 17.6% year-over-year increase in August 2023. By contrast, residential construction spending decreased by 3% for the same period, underscoring the overall weakness in the housing market (figure 2).

For the residential segment, the performance of the housing market in 2024 depends on broader economics. From January to August 2023, total housing starts decreased by 13% compared to the same period of the previous year largely due to a rise in interest rates and inflation.30 According to Bureau of Labor Statistics data, housing inflation in US cities rose to 5.7% year over year in August 2023 and was a significant contributor to the increase in core consumer price inflation. Given the segment’s sensitivity to economic cycles, continued high interest and mortgage rates will likely affect housing affordability, reduce demand, and restrain the segment’s activity. Deloitte’s United States Economic Forecast predicts only modest growth in housing construction through the next year.31

The nonresidential segment, on the other hand, is likely to continue to grow steadily as federal funds flow into the construction of chip fabrication plants, biotechnology facilities, EV battery factories, and other clean energy projects in 2024, and as several high-value projects break ground.32 Manufacturing construction spending had the largest annual increase in construction spending of 65.5% as of August 2023. Manufacturing construction is likely to grow further in 2024, buoyed by funding of more than US$52 billion from the CHIPS Act and close to US$152 billion from the IRA and IIJA.33

Furthermore, with IIJA funds flowing into projects, transportation infrastructure construction spending increased 9.4% year over year in August 2023. Going into 2024, there could be a more prominent impact of IIJA funding,34 with around US$58.8 million earmarked for transportation, broadband, climate, and energy construction projects.35 Substantial infrastructure investments from state and local governments are also likely to drive growth.36

Finally, the IRA has also created opportunities for the construction industry through tax credits and energy incentives for the expansion of clean energy infrastructure, such as renewable energy generation facilities and electric transmission facilities, with various funding opportunities available through late 2024.37

Despite the flow of public funds, market uncertainty will likely influence various aspects of construction projects in the nonresidential segment. Project deliveries may be delayed due to financing challenges and disruptions in the supply chain. Margins could diminish as the cost of materials and labor fluctuates in response to economic uncertainty. Financing could become more expensive as interest rates fluctuate and impact the feasibility of certain projects. Finally, backlogs in the segment—which can help E&C firms sustain operations through economic uncertainties—may be reduced if ambiguity in timelines and financing of new projects persists in the coming year. As of August 2023, backlogs in the nonresidential segment had increased to 9.2 months38 and are expected to sustain the segment going into next year.

As companies decide on the necessary next steps to navigate uncertain economic times, the industry may experience an increase in mergers and acquisition activity. Between October 2022 and September 2023, the industry recorded 184 M&A deals, with a total estimated value of completed deals at US$3.7 billion.39 Many of these deals are likely aimed at strategic expansion into new markets to better access additional revenue streams or at horizontal integration to help achieve cost efficiency and enhance resilience to market fluctuations. The industry also recorded 84 M&A deals from private equity investors, with a total deal value of US$4.5 billion.40 M&A activity from private equity investors may increase as they continue to invest in infrastructure assets and capital projects.

E&C companies will likely need to make strategic decisions based on their capabilities to overcome ambiguities in the market. Some construction companies may choose to focus on their core business, deepening their expertise and averting risk. On the other hand, some may choose to reinvent or expand by making targeted investments in business transformation and/or new M&A activity to reap greater rewards when the market regains stability.

4. E&C firms likely to be more strategic to navigate persistent cost volatility

US construction firms have been facing significant cost pressures driven in part by frequent fluctuations in labor costs and material prices in the last few years. Cost fluctuations can complicate project planning and prompt deliberations over pausing or terminating projects. Several firms have canceled or changed the scope of their projects due to increasing costs.41 Managing cost volatility is a top priority for firms and can slow down construction starts if not managed closely.

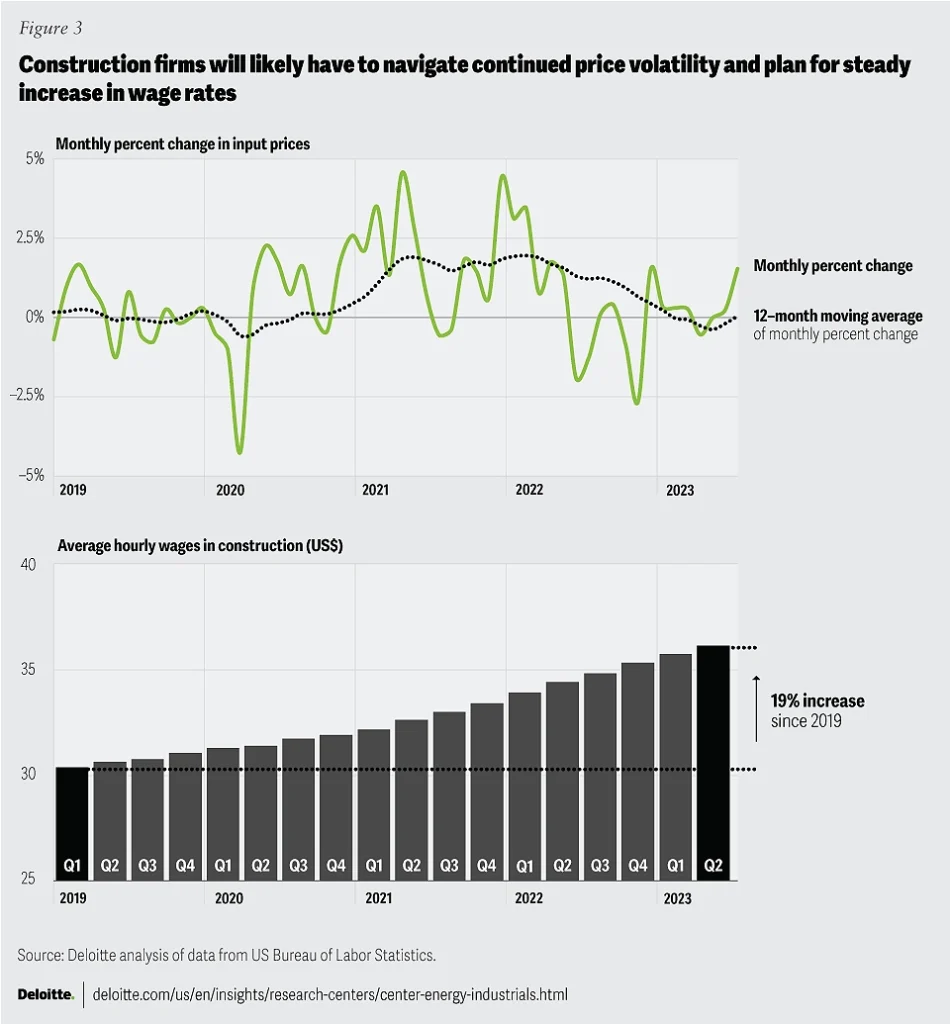

The average wage rates in construction have been rising steadily. According to BLS data, average hourly wages increased by 5.2% year over year to US$36.70 in August 2023 and around 17% since the beginning of the pandemic lockdowns in March 2020 (figure 3). Construction wages are expected to experience upward pressure in 2024 as labor demand continues to outpace supply. This situation may affect smaller firms more and render them more vulnerable against larger counterparts capable of offering competitive salaries to attract talent. Rising wage rates can also have an impact on project execution and profit margins, especially if the elevated costs cannot be transferred to clients.

Price volatility continued in 2023 despite a moderate abatement in the prices of key raw materials in the first few months of 2023 (figure 3). The third quarter of 2023 has once again seen a rise in prices. These prices have not returned to prepandemic price levels, affecting the profitability of many projects. As E&C firms work to navigate cost volatility, they should consider several keys for pricing:

The overall price of construction inputs increased 0.1% year over year in August 2023.45 Moreover, prices have increased by 40.7% since February 2020.

Prices of raw materials such as iron and steel, lumber and wood products, softwood lumber, and steel mill products declined in August but remain well over pre-pandemic prices.47

Construction machinery and equipment costs increased by 6% year over year in August, and by over 26% since February 2020. Similarly, concrete products prices increased by over 8% year over year in August, and by over 32% since February 2020.

These price levels could increase the bid prices and project costs, affecting the profitability of E&C firms. As construction equipment prices increase and as tools manufacturers continue their recovery from recent supply chain challenges, E&C companies may increasingly turn to equipment and tools leasing and financing in 2024. Although prices of raw materials could stabilize within the next few months, machinery and equipment prices are likely to remain high as lead times continue to prolong deliveries.

In 2024, E&C companies could consider the following operational strategies to help recover cost increases:

- Discussing and establishing fixed payment terms with customers, as irregular or inconsistent payment terms can impact the company’s financial performance

- Implementing supply chain strategies such as category management, strategic supplier contract negotiations, and strategic procurement

- Applying a disciplined cost/overhead (i.e., operations not charged to customers) management approach, as backlogs may not remain sustainable

- Engaging with customers early in the project life cycle for better decision-making and planning, thereby expediting design choices and enabling advanced procurement of raw materials

- Monitoring and analyzing cost data to streamline operations and pinpoint optimal project types

- Leveraging prefab and modular construction methods to help keep material costs down, reduce labor costs, and shorten project schedules, thereby curtailing budget overruns.

5. E&C firms likely to adapt to new work and workforce norms

The E&C industry continues to grapple with filling open workforce positions and is faced with a significant labor gap. In August 2023, job openings in construction totaled 350,000, a 1.4% increase year on year and more than 13% higher than prepandemic levels. At the same time, the quit rate is still higher than the rate of layoffs and discharges—highlighting the voluntary exit of the workforce.

As mentioned in last year’s outlook, the rise of remote work and greater career flexibility contributed to retention issues in the E&C space.50 It now plays a significant role in the increasing number of job openings. The ABC recently reported the E&C industry needs more than 342,000 new workers in 2024.51 The rise of wages across multiple sectors is driving potential workers to opt for safer, less physically demanding positions—for example, those in the service and IT industries.52 Furthermore, the pipeline of workers is diminishing as support for the trades in many high schools has given way to emphasis on computer learning.

This unavailability of skilled workers can directly influence a company’s capability to meet their commitments. Due to a lack of available qualified candidates, 68% of construction firms surveyed are struggling to fill open positions. In order to meet the incoming demand for work, 69% of surveyed firms expect to increase headcount in the next year.

Moving from a strategy focused on retention, as outlined in the 2023 outlook, to a strategy for filling the talent gap created by the above challenges, is further complicated by a retiring and aging workforce in E&C. Over one-fifth of construction workers are older than 55 years and often represent the most skilled workers on a job site. In hiring, firms struggle to find younger workers with comparable skills. An ABC study found that a majority of surveyed executives are extending their outreach to include high school graduates, community colleges, veterans, and people who are reentering the workforce. Such outreach programs can help executives engage both a broader and more diverse workforce.

While the industry has made progress in adapting to the labor shortage, E&C firms can follow a multipronged approach to shifting their focus from retaining talent to tapping into and developing leading talent in the coming year:

- +he 2023 outlook found that a flexible and agile workforce can help E&C companies attract and retain talent. Expanding on that, many younger workers seem to be drawn to the gig economy, where they can work as contract employees for multiple employers rather than committing to a single employer. This approach not only allows firms to tap into a broader pool of talent but also offers the flexibility many workers seek.

- Invest in upskilling and cross-skilling programs: Apprenticeship and training programs can help to meet E&C companies’ talent challenges. ABC reports that contractors invested US$1.5 billion in workforce development in 2022 benefiting more than 1.3 million course attendees.57 Construction firms have increased spending on training and professional development and also increased use of online training programs in the last 12 months to attract talent.58 Companies can also cross-train their employees in other functions and broaden their expertise to create a flexible, efficient workforce.

- Prioritize worker safety: Improving working conditions with a strong emphasis on safety can make construction more appealing to potential recruits. Safety education accounted for most of the total workforce investment in the first half of 2023.59

- Offer competitive compensation and benefits: Offering competitive wages and benefits is vital. A higher income potential can help attract a wider talent pool. Many E&C firms surveyed have increased base pay and bonuses or other incentives, and initiated employee benefit programs in the last 12 months to retain and attract top talent.60

- Take advantage of broader incentives: The IRA tax credits available for companies who hire registered apprentices may build demand for apprenticeship programs, potentially expanding workforce training opportunities and benefitting employers.

- Leverage robotics, automation, and other cutting-edge tools: Robotics and automation can help in reducing or removing human workforce from high-risk and exposed areas. It can also minimize reliance on specific job roles and can help cross-skill other workers (e.g., carpenters doing layout designing by using robotic solutions). Technology-driven solutions enhance efficiency and collaboration. Additionally, adoption of technology can make the industry more appealing to a tech-savvy younger generation. Two in three construction firms surveyed agree that the use of cutting-edge tools helps them recruit talent.61 Several firms also agreed that AI and robotics will improve safety and productivity of the workforce.62

- Boost diversity, equity, and inclusion in hiring: This trend from last year’s outlook remains highly relevant, as hiring a diverse workforce and attracting prospective employees from new sources of talent, including veterans, persons with disabilities, and returning workers, in addition to women and underrepresented ethnic groups, will widen the talent pool. Diversity is an important driver of innovation and success. About 77% of construction firms believe that diversifying their workforce is crucial for their future business.

Looking into the future: Agility and adaptability founded on digital transformation could be key for industry competitiveness

The E&C industry has demonstrated strong resilience in the face of persistent pressure and economic fluctuations. As we move into 2024, the growing focus on sustainability and efficiency, even amid economic uncertainty, emphasizes the importance of agility and adaptability. E&C companies can remain nimble through the continued adoption of new technologies, analytical methods, and the engagement of a broader workforce. Digital transformation can help E&C companies develop new synergies while improving efficiency, reducing emissions and waste, decreasing costs, generating new value streams, and enhancing talent and program management. Leveraging cutting-edge technologies, such as generative AI, can provide a competitive advantage to E&C firms in 2024. Furthermore, E&C companies can compete on both cost and revenue by accessing government incentives offered by the IRA, IIJA funding streams likely to hit the market in 2024, or both. Finally, E&C firms should continue to embrace change, not merely as a response to external pressures but as a strategic imperative to better thrive in an uncertain macroeconomic environment.

In the coming year, E&C companies may add the following to their strategy playbook for navigating uncertainty, strengthen competitiveness, and take advantage of the opportunity at hand:

- Focus on the economics of sustainable construction with the usage of high-performance building materials and energy-efficient systems.

- Continue to invest in a digital foundation with BIM and robotics and explore applications of emerging technologies, such as generative AI, to enhance efficiency.

- Leverage data-driven insights for better decision-making and safeguarding financial performance.

- Invest in workforce development through apprenticeships and training programs, as well as in automation tools, worker safety, and expanded DEI representation in hiring.